Senior Solutions

Compassionate Guidance for Life’s Later Chapters

As we get older, our needs change and so should our protection. Whether you're turning 65, already on Medicare, helping a parent age with dignity, or planning ahead to ease the burden on your family - you're in the right place.

At ClarVia Benefits Group, we specialize in helping seniors and their families protect health, income, and legacy through every stage of aging.

We make it simple. No pressure. No cost to meet .No obligation to enroll. Just honest support from someone who's been through it.

Medicare Guidance

We make Medicare simple and help you choose what’s best for YOU and not a company. No pressure, no favorites, just the right fit for your needs.

• Medicare Advantage

• Medicare Supplement(MediGap) Plans

• Prescription Drug Coverage (Part D)

• Savings Programs (Extra Help, Medicaid, LIS)

⏰ Enrollment Periods are Time-Sensitive

We’ll help you avoid penalties, missed deadlines, and coverage gaps

Accident & Illness Protection

Fill the gaps Medicare doesn't cover with supplemental plans that pay cash benefits for when the unexpected hapens.

• Home Care (Caregiver) & Long Term Care Plans

• Hospital Indemnity Plans

• Cancer, Heart Attack & Stroke Insurance

• Critical Illness Coverage

💵 Medicare doesn't cover everything.

Get paid directly to help with out-of-pocket costs when you need it most

Funeral & Final Planning

There are many ways to cover your funeral and final expenses. Lift the emotional and financial burden from your family by planning ahead.

• Final Expense Life Insurance

• Preneed & Prepaid Funeral Plans

• Legacy of Love Planning Tool

• Lifetime Funeral Travel Protection

📝 Leave a legacy, not a mess.

Everyone’s needs, wishes, and budget are different.

We’ll help you find the type of plan that fits your life

What is Original Medicare?

Original Medicare is the United States’ federal health insurance program for people who are 65 or older. It is also available for certain people younger than 65 with disabilities or people with End-Stage Renal Disease. There are several parts to Medicare that contain different coverage.

What is Part A?

Medicare Part A covers inpatient hospital care, skilled nursing, hospice, surgery, and home healthcare. Deductibles and cost-sharing will apply. Most folks will not have to pay Part A premiums.

What is Part B?

Medicare Part B covers doctor visits, preventative, outpatient services, and lab tests. Deductible and cost-share will apply. Part A and B comprise what is known as “original medicare".

What is Part C?

Part C, also known as Medicare Advantage, takes the original medicare and privatizes it. In other words, a Medicare Advantage plan bundles Part A, Part B, and usually Part D into one single comprehensive plan with a private carrier.

What is Part D?

Medicare Part D is also known as prescription drug coverage. Part D coverage is available as a Stand Alone Option (PDP) or as part of a Medicare Advantage plan (Part C). Part D plans are offered by private insurance companies contracted and approved by Medicare.

Enrolling in Medicare

Timing matters when it comes to Medicare. Missing key deadlines can mean late penalties, coverage gaps, or limited options. Here's what you need to know:

Initial Enrollment Period (IEP)

Your first chance to enroll in Part A & Part B of Medicare.

You can sign up during the 7-month window:

➡️ 3 months before your 65th birthday month

➡️ The month of your birthday

➡️ 3 months after

If you're already receiving Social Security benefits, you’ll be automatically enrolled in Medicare Parts A & B. No need to apply!

Tip: Enroll early to avoid delays in coverage.

General Enrollment Period (GEP)

This is if you missed your Initial Enrollment for Part A &/ Part B

📅 January 1 – March 31 (every year)

Only if you didn’t sign up when first eligible and have no qualifying Special Enrollment Period

Coverage begins: July 1 of that year

Important: You may have to pay late enrollment penalties for Part B and/or Part A (if you didn’t qualify for premium-free Part A).

Annual Enrollment Period (AEP)

Medicare Advantage or Part D plans may change annually:

📅 October 15 – December 7 (every year)

Review the changes of your Medicare

Advantage Plan &/ Part D Plan

Switch plans if needed

Drop coverage

Enroll in a new plan

Changes take effect January 1.

Special Enrollment Period (SEP)

You may qualify for a Special Enrollment Period if:

You retire or lose employer coverage

You move to a new ZIP code or service area

You have a change in Medicaid or Extra Help

You’re released from incarceration

You experience other qualifying life events

We’ll help you find out if you qualify and walk you through the process.

How to Apply for Medicare

If you're turning 65, the easiest way to sign up is online:

1. Visit www.ssa.gov/medicare

Or call Social Security at 1-800-772-1213

Or apply in person at your local SSA office

2. Create Account at www.medicare.gov to manage payments, and more

Medicare Supplements

What is a Medicare Supplement?

Also known as Medigap, Medicare Supplement plans help fill the “gaps” in Original Medicare (Parts A & B). These plans are sold by private insurance companies and help cover costs like:

● Deductibles

● Coinsurance

● Copayments

● Hospital stays

● Skilled nursing facility care

● Even emergency care while traveling abroad (with some plans)

If you’re looking for peace of mind and fewer surprise bills, a Medicare Supplement plan can be a powerful solution.

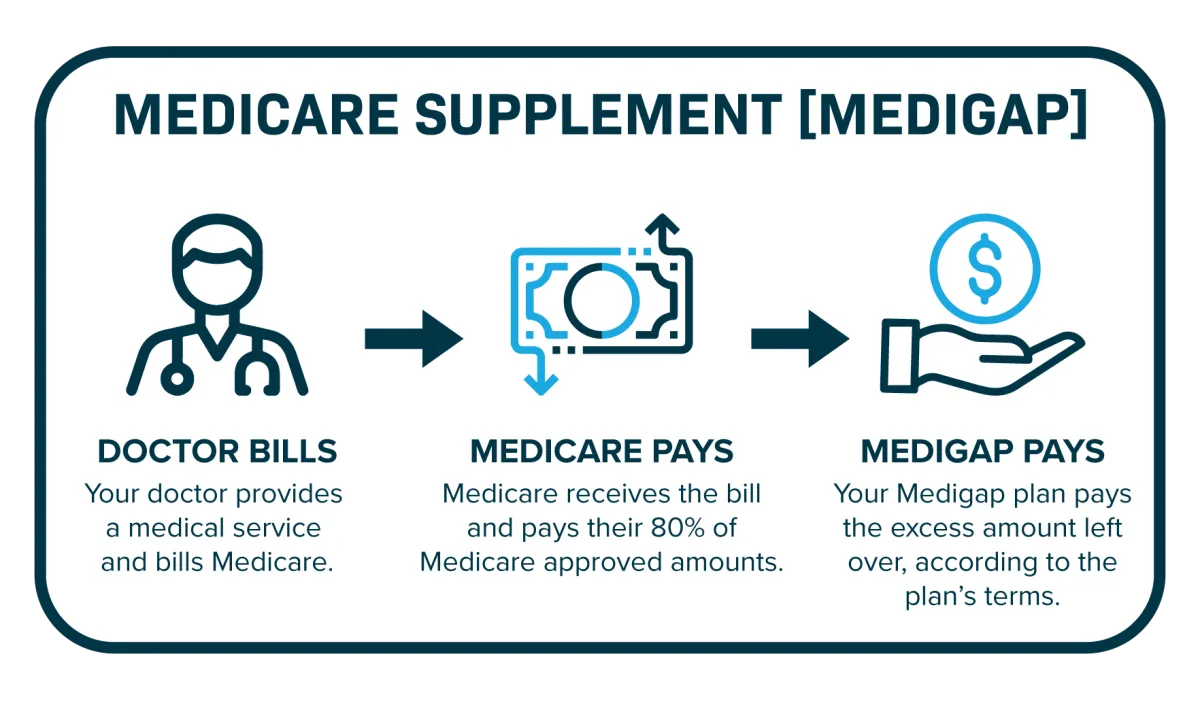

How do They Work?

Medicare Supplements, or Medigap plans, work with Original Medicare—not instead of it. Medicare pays first, and your Supplement plan helps cover your share of the costs. That means:

✔️ You keep your Original Medicare benefits

✔️ You can see any doctor who accepts Medicare—no networks

✔️ You enjoy predictable, reduced out-of-pocket costs

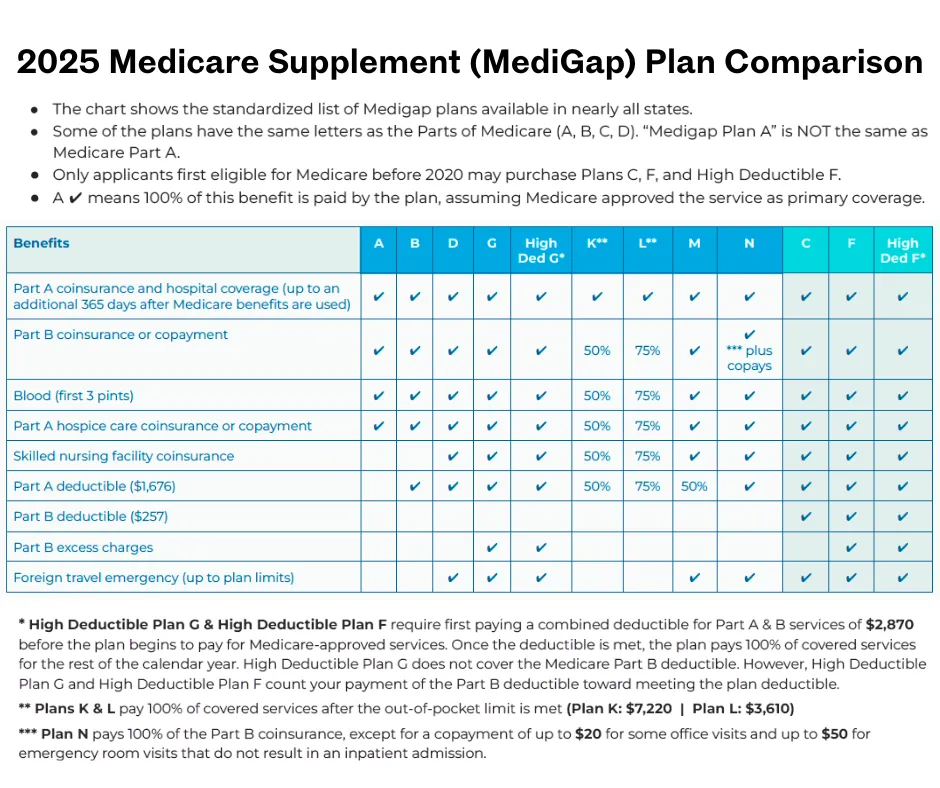

What are the Different Plans?

Medicare Supplement plans are labeled with letters: Plan A through Plan N. Each lettered plan offers a different set of standardized benefits, but coverage is the same no matter which insurance company you buy it from.

For example:

Plan G is the most comprehensive option available to new enrollees—it covers everything except the small annual Part B deductible

Plan N offers lower premiums in exchange for small copays when you visit the doctor or ER

5 Things to Know

1. You must have Medicare Parts A & B to enroll.

2. Medigap is not the same as Medicare Advantage. It supplements Original Medicare—it doesn’t replace it.

3. You pay an monthly premium for your Medigap plan (in addition to your Part B premium).

4. If you apply for a Medigap policy outside your initial Open Enrollment Period, you may have to undergo medical underwriting. This means you could be denied coverage or charged more based on your health.

5. You can’t have Medigap and Medicare Advantage at the same time. You must choose one or the other.

* IMPORTANT *

If you choose a Medicare Supplement (Medigap) plan, it’s important to know that prescription drugs are NOT included. To avoid late penalties and ensure you have the medication coverage you need, we strongly recommend enrolling in a standalone Medicare Part D Prescription Drug Plan.

We’ll help you choose a plan that covers your prescriptions at the lowest cost.

Medicare Advantage

What is Medicare Advantage?

Also known as Part C, Medicare Advantage plans are all-in-one alternatives to Original Medicare. These plans are offered by private insurance companies approved by Medicare—and they bundle your hospital (Part A) and medical (Part B) coverage into one plan.

Most also include extra benefits like:

● Prescription drug coverage (Part D)

● Dental, vision, and hearing

● Transportation, gym memberships, and even over-the-counter items

● Some plans even offer money back on your Part B premium!

How Do They Work?

With a Medicare Advantage plan:

✔️ You still have Medicare, but your coverage comes from a private insurance company

✔️ You may need to use in-network providers (HMO or PPO, depending on the plan)

✔️ You pay low or $0 premiums in many cases

✔️ You may have set copays for doctor visits, specialists, and hospital stays

What are the Different Plans?

There are several kinds of plans available, depending on your area:

● HMO (Health Maintenance Organization): Requires referrals and in-network care

● PPO (Preferred Provider Organization): More flexibility with out-of-network coverage

● SNP (Special Needs Plan): Designed for those with chronic conditions or Medicaid

● MSA (Medical Savings Account): Combines a high-deductible plan with a Medicare-funded savings account

Each plan has its own pros, cons, and coverage extras. We’ll help you compare your options.

5 Things to Know

1. You must have Medicare Parts A & B to enroll.

2. You may still pay your Part B premium, but many plans have low or $0 additional cost.

3. You usually use a provider network. Out-of-network care may cost more (or not be covered, depending on the plan).

4. Plans change every year. It’s smart to review your plan annually during Open Enrollment.

5. You can’t have both Medicare Advantage and Medigap. You must choose one or the other.

Is It Right For You?

These plans are great for people who:

✔️ Want bundled benefits (dental, vision, drugs, and more)

✔️ Like the idea of $0 premiums and predictable copays

✔️ Don’t mind using a provider network

✔️ Want extra perks that Original Medicare doesn’t offer

If you want more benefits with fewer bills, Medicare Advantage might be a smart fit.

Get Help with the Expenses Medicare Doesn't Cover

Hospital Indemnity Insurance

Get Paid When You’re Hospitalized

Even with Medicare, hospital stays can leave you with hundreds—or thousands—in out-of-pocket costs. Hospital indemnity plans pay cash directly to you to help cover:

Deductibles

Daily hospital stay costs

Ambulance rides

Skilled nursing care

And more

Use the money however you need—whether it’s for medical bills or keeping up with everyday expenses while you recover.

Cancer, Heart Attack, Stroke, Critical Illness

One Diagnosis Shouldn’t Drain Your Savings

A serious illness doesn’t just impact your health—it can affect your finances too. These plans provide a lump sum of cash if you're diagnosed with:

Cancer

Heart attack

Stroke

Kidney failure

Major organ transplant, And other critical conditions

You can use the money for treatment, travel, lost income, or anything you need during recovery.

Long-Term Care Insurance

Plan Ahead for the Cost of Aging

Medicare does not cover long-term or custodial care like help with bathing, dressing, or eating. Long-term care insurance helps cover:

Assisted living

In-home care

Nursing home stays

Adult day care

Protect your independenceand your family’s finances by planning ahead.

Short Term Care & Home Care Plans

Stay Home Longer with the Support You Need

Most people want to age in place, but home care services can be expensive—and often aren’t covered by Medicare. These plans help pay for:

In-home caregiving

Help with daily activities

Meal prep, light housekeeping

Personal care services

Affordable, flexible plans available, no medical exam required.

Custom Coverage that Works for YOU

We don’t believe in one-size-fits-all insurance. With access to a wide range of life and health plans with multiple insurance companies, we help you:

✔ Fill coverage gaps

✔ Avoid surprise expenses

✔ Protect your health, income, and loved ones

Our job is to make sure you’re covered—exactly where it counts.

Medicare Plans

Medicare Supplements, Medicare Advantage Plans, Prescription Drug Plans

Aging Care | Home Care| Long Term Care

Medicare does NOT cover long-term or custodial care like help with bathing, dressing, or eating. These services must be planned for separately.

Accident | Hospital Indemnity

Helps pay for out-of-pocket expenses if you're injured or hospitalized

Dental | Vision | Hearing

Affordable coverage to maintain your smile, eyesight, and hearing health

Cancer | Heart Attack | Stroke | Critical Illness

Cash benefits to help ease financial stress after a serious diagnosis

Pet Insurance

Coverage to help manage unexpected vet bills - with added Member Discounts & Perks

Life Insurance

Protection for your loved ones - with or without living benefits. Term, Whole Life, Universal Life, Indexed Universal Life, Accident

Funeral Planning

Preneed (pre-paid) Funeral Plan, Final Expense/Burial Insurance, Family Membership

Travel Plans

Health Insurance when traveling abroad; Repatration Plan to cover travel expenses to bring you home you if you pass away more than 75 miles away

Prefer a Personalized Emailed Quote? Fill out the Form Below

Getting the Right Coverage Can Be Difficult

We know insurance can feel overwhelming. That's why we take the time to educate, so you can make confident decisions based on your unique situtation

Which company is the best?

Whether reviewing life or health insurance, the best company is based on your health, budget, & needs. We'll help you compare and decide.

What type of plan do I need?

Everyone's situation is different. We'll analyze your goals and guide you to the plan that best protects what matters most.

What if I have insurance through my employer?

If there are 20 or more employees, you can delay Medicare Part B without penalty. Once that coverage ends, you have a Special Enrollment Period to sign up for Part D & Medicare.

FOLLOW US

COMPANY

LEGAL

Copyright ClarVia Benefits Group LLC 2025. All Rights Reserved.

Not affiliated with or endorsed by the United States government or the federal Medicare program. We do not offer every plan available in your area. Any information we provide is limited to those plans we do offer in your area. Please contact Medicare.gov or 1-800- MEDICARE to get information on all your options. If you have any additional questions please contact us at 725-777-2338. Any redistribution or reproduction of part or all of the contents in any form is prohibited. You may not excerpt with our express written permission, distribute or or commercially exploit the contents in this site. Medicare has neither reviewed nor endorsed this information.